You finally took the plunge and decided to start your own eCommerce business! Congratulations. Furthermore, you decided to maximize your margins by choosing branded eCommerce over dropshipping.

You took the time to research the product you wanted to sell and achieved product-market fit. You then found a contact in China who was willing to manufacture the product for you at an extremely reasonable price. Now, you want to ship your products from your supplier in China to either your home or your United States fulfillment center.

There’s only one problem: you realize that you had not considered the process of importing the products from China into the United States!

If you’re like so many eCommerce companies that struggle with importing products from China, or you’re just looking for a better way to streamline this process, this guide is for you!

Understanding the Big Deal

As much as we are moving towards a global economy, there are still major distinctions between national procedures, regulations over certain products, tariffs pertaining to trade pacts, and more. The import process is really all about maintaining harmony between nations and preserving trade equilibrium.

Double Check with Your Manufacturer

Your first point of contact will be the manufacturer itself. You likely spent a good deal of time trying to find the right manufacturer for your product, and you hopefully have an excellent working relationship with them thus far. The import/export moment is a critical step in the supply chain, and you want to ensure that they have your best interests at heart.

It’s important to remember that while this may be your first time with a Chinese manufacturing company, this is almost assuredly not their first time dealing with someone in the United States. If you stumble at any point in this process, you can leverage your relationship with your supplier to entice them to guide you.

When you check with your manufacturer prior to shipment, you want to make sure that all products are built to your specifications. Get photos or even arrange to have a sample product shipped. You want to make absolutely sure that your products are going to be ready for resale.

Once you have cleared the products with them, you may want to consider negotiating packaging of your inventory.

Note that there are independent freight forwarding companies and import clearance firms that can help assist you with this step. However, it is always advantageous to have your manufacturer handle this part, because fewer “touches” of your product means fewer opportunities for errors. If you have to pay a bit more to have the manufacturing company package your parcels, it will be an expense worth incurring.

Preparing on Your End

Your products are packaged and ready for shipment from the manufacturer, but now you have to handle your part of the bargain.

First, you’re going to need to know some terminology. When you import products from China, you become the “Importer of Record”. This is really a fancy way of saying that this whole process is “on you” once it arrives, and that you are the person (or corporate entity) importing the product in question.

You’ll want to familiarize with a few concepts as the importer of record. Fortunately, the US Customs and Border Protection department website is a terrific and informative resource for you! You can learn about any required licenses or permits required to import your products, which is where you want to start. After all, the rest of the process won’t do you much good if you aren’t licensed to import your product!

The next thing you’ll want to find out is your product’s tariff classification number or Harmonized System code (also known as an HS Code). You can look up the HS Code of your product on the website of the U.S. International Trade Commission.

Now that you have any required licenses and permits and have the HS code of your product, you’re ready to set up freight delivery to actually ship your products!

Incoterms and Freight Preparation

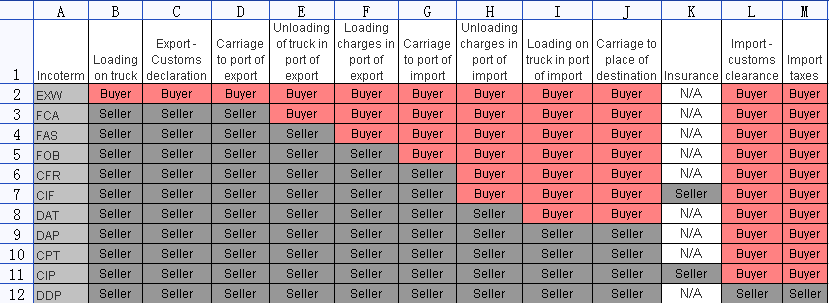

‘Incoterms’ are International Commercial Terms, which are essentially freight shipping terms. Incoterms dictate precisely who is responsible for the shipment at various points in transit.

There are a lot of complicated conditions for Incoterms, but essentially what they are is an agreement between the buyer and the seller. That is, at what point is the shipment the buyer’s responsibility vs. the seller’s?

In the chart above, you can see who is responsible for what. There are three very commonly used Incoterms, and there’s one that is almost universally agreed upon as the best. So naturally, we’ll save the best for last and talk about the other three first.

EXW: As you can probably imagine, manufacturers love EXW. The entire process depends on the buyer – the seller’s job is literally done once they finish making the product. Some buyers utilize EXW to retain complete control, but this is an expensive proposition, and there are very few situations in which we would recommend using this Incoterm.

DAP: On the other end of the spectrum, DAP is one of the best arrangements for the buyer. With the DAP Incoterm, the seller is responsible to everything except for import customs clearance and import taxes. This method is reasonably popular, but as you can see it is skewed heavily in favor of the buyer.

FOB: This is the most common incoterm we encounter and the most equitable all around. The seller is responsible for getting the products loaded on the truck from the factory and filling out the export declaration. From there, the seller will ensure that your products get to the port for shipment. The seller will also make sure that the truck is unloaded and the freight vessel (whether a ship or a plane) is loaded properly. At this point, the responsibility shifts over to the buyer. The buyer is then responsible for getting the freight to the port of import and unloading it and getting the products shipped to the ultimate destination. They will also pay any import taxes and handle customs clearance.

Because FOB is equitable for both parties and because it afford the buyer excellent control on a budget, we recommend selecting FOB.

Now that you’ve waded through the world of Incoterms, you’re ready to choose a Shipping Method!

P.S. If you want to get more in-depth, we also cover international terms here!

Select a Shipping Method

There are realistically four main ways that you can ship your product from China to your US based location, and the best method ultimately depends on your needs. Ultimately, this is functionally a battle between air and sea, but there are still two other options that merit mention.

China Post: This is the Chinese equivalent of shipping USPS. It’s great for small shipments, and it takes about 2-5 weeks for your product to arrive. While it is economical, there is very limited recourse available should anything happen to your product. Generally speaking, this is probably not the best option.

Global Courier: You can go with a private courier company, or you can use one of the express services offered by DHL, UPS, or FedEx. These packages can arrive in a mere 2-5 days anywhere in the world. You also have a very robust tracking network that allows you to essentially see where your product is at all times. They also handle your customs clearance! The downside? This is an extremely expensive way to ship goods. While it is a better alternative than China Post for small shipments, this is likely not the right choice for you if you are shipping pallets worth of goods.

Air Freight: If you ship at high volume, you may consider going with air freight. What constitutes “high volume”? As you may expect, the precise number is subjective. The tipping point is typically somewhere in the neighborhood of 300 pounds. At this point, air freight becomes more practical than a courier service. Understand that air freight is comparable in speed to a global courier service (usually within 7 days). Unlike with a courier, you will be responsible for all of the customs clearance, which means more work on your part.

Sea Freight: What if you’re shipping at high volume and time isn’t the paramount issue? If that’s the case, you should consider the undisputed king of commerce transit: sea freight. Sea freight from China takes a long time, and it will usually take 1-2 months for you to receive your product. However, it is not only very cost effective, but there is virtually no limit to the size of products you can import on a container ship from China. You’ll have to handle customs clearances yourself, but the aforementioned resources should make you completely confident to handle this process.

Now that you’ve selected the right shipping method, it’s time to ask yourself about shipping management.

Freight Forwarding and Shipping Management Services

These two terms are basically interchangeable. Do you remember the Incoterm guide? Specifically about the trucking companies, the delivery, the port unloading, etc.? If you, the Buyer, are working under the FOB plan, you’ll be responsible for all of these details! After all, a truck is unlikely to magically appear at the port and deliver your products for you!

Here, you have two options. You can either handle these logistics issues your own for maximum control and efficiency, or you can partner with a freight forwarding agency.

The upside to handling all of this business yourself is that you will retain full control over precisely who touches your freight at each point in the process. The downside is that logistics is far more time consuming than most entrepreneurs imagine. There are many mechanisms that need to be synchronized and, unless you have enterprise logistics software or a fleet of employees ready to see this process through to completion, it is unlikely that your time would be best spent going in this direction.

Enter freight forwarders. You can go with either a US based or a Chinese based freight forwarder. In fact, you can sometimes go with both and have them synchronize efforts.

Whereas your job is testing the market, designing the product, handling customer outreach, and sourcing manufacturing, freight forwarders exist to handle one thing: freight forwarding. While the added expenditure is nontrivial, this is by far the best way to ensure that your product follows the steps from your manufacturing facility to your fulfillment center.

Clearing Customs

You’ve done it! Your products have shipped from China to the USA using the FOB Incoterm, and you figured that you would drive to the port of entry in a truck to transport the goods.

There’s just one small problem: your products are held up in customs and cannot yet be released.

What you could really benefit from at this point is a Customs Broker. A customs broker is simply any person or corporate entity licensed and (very importantly) empowered by the U.S. Customs and Border Protection Office to facilitate imports and exports. These are the people who are going to be able to help you get your products to clear customs and release your product to you.

Here are some of the things a Customs Broker will help you navigate and some of the associated fees:

- Bill of Lading (BOL): Some brokers charge to set up the Bill of Lading, which is documentation outlining all the goods in the shipment.

- Import Security Filing (ISF): This is documentation for the US Department of Customs and Border Protection about the contents of your shipment. Expect to pay in excess of $50 for this document.

- ISF Bond: This bond costs a flat fee of $50, and must be purchased in addition to a Single Entry Bond (detailed below).

- Entry Bond: This documentation, coupled with an ISF bond, is required if you are interested in importing without a continuous transaction bond. This fee will vary commensurate with the value of your goods, but you should expect to pay at least $45 for this.

- Entry and Messenger Fees: To handle the actual import itself, customs brokers will frequently charge you messenger fees and entry fees. These fees can run in tandem around $120-$150, typically.

- Merchandise Processing Fee (MPF): This is another variable fee based on your products’ value that is a minimum of $25 and a maximum of around $500.

- Harbor Maintenance Fee (HMF): Even the port is going to get in on your action. You can expect to pay an HMF of around $10.

- Duties based on goods: This is a percentage fee that varies by country and the nature of your goods.

This list, while generally comprehensive, does not fully list every possible fee that you and your customs broker can encounter upon import.

While it may seem easy to do yourself, going with a customs broker will spare you considerable effort. You will also be assured this way that you are only paying the requisite fees for import, which is a particularly problematic area for many entrepreneurs new to foreign imports. Customs duties can be exorbitant, and there are legal ways to reduce the importer of record’s total customs liability.

Need Help?

If all of this sounds daunting and complicated, don’t worry: it absolutely is. The logistics industry is built in part around the fact that there are so many moving parts that functionally have nothing to do with commerce, but that must be addressed accurately, punctually, and professionally in order for commerce to function.

The good news is that some fulfillment centers like ShipMonk have their own customs brokers and freight forwarding partners. We strongly recommend that, if you are outsourcing fulfillment, you contact your fulfillment center and see if they will be able to assist in ensuring your product arrives safely from your manufacturer to your fulfillment center.

Because at the end of the day, you need as few obstacles as possible to get the product into your customer’s hands. We hope this guide on importing from China has been helpful.